Canara Bank Savings Account Interest Rate

IN THIS ARTICLE

- Canara Bank Savings Account Interest Rate Monthly

- Canara Bank Online Account

- Canara Bank Nre Interest Rates

- Canara Bank Interest Rates 2020

Having a bank account simplifies management of financial transactions. Any type of transaction whether it is a fund transfer, saving your earnings or pay salaries to the employees can be managed easily with customized Canara Bank Accounts.

Current Canara Bank FD interest rates on regular fixed deposit schemes can help investors to save and earn decent returns with minimal risk. Minimum deposit of ₹1000 - The minimum deposit to open a fixed deposit in Canara Bank is ₹1000. Given the focus on rural development, this nominal amount is easy for most people across the country. Canara Bank Savings Account Interest Rates and Charges The rate of interest offered on the account is between 3.25% and 3.75%. This is a fixed rate and remains static through the period of account’s operation.

Canara Bank Type of Accounts

Canara Bank provides different types of accounts for different categories of customers depending on their needs.

The savings bank account can be opened individually or jointly. The account is for minors, blind people, trusts, government bodies, illiterates, non-corporate bodies, and HUF. The account can be opened easily by submitting an account opening application at the nearest Canara Bank. Along with the application, the applicant should provide address proof, passport size photograph, and identity proof. The running account provides an interest of 4.00% per anum. The interest obtained on the amount existing in the account is paid quarterly in the months of February, May, August, and November. The applicant can choose to include a nominee for the account. Along with the savings account, the customer is provided with a Canara Bank Debit Card and passbook. Savings bank account holders can avail the features such as providing standing instructions for monthly bill payments, collection of the cheque, the internet and mobile banking. Customers maintaining a minimum balance of Rs.10,000 per month are eligible for obtaining free 2 DDs per month without paying a processing fee.You can check your account balance on Canara Bank Net Banking with out visiting the bank.

You Can Also Check Here For Hassle Free Banking

The Canara Bank current account is for individuals, joint accounts involving more than four, entrepreneurs, partnership firms, public limited companies, registered and unregistered societies or associations, executives and administrators, charitable and religious institutions, and government and semi-government departments.You can dirctly contact the Canara Bank Customer Care at any time regarding banking assistance.

The Canara Bank Payroll package saving bank account is for employees of firms or corporate with a minimum of 25 employees. It is mandatory for the firms to credit their employees to the Canara payroll package scheme savings bank account. The initial deposit amount is zero. The interest rate on the amount existing in the account is calculated on the daily basis and is paid quarterly. The interest rate is 4% per annum. The value added services that are available with the salary account are the platinum debit card with photo, Rs. 50,000 withdrawal limit from bank ATM, e-statement of the account for free once in every 15 days, IMPS service, SMS alert for the transactions related to the account, net banking, one cheque book with 200 leaves per month free of cost, 50% discount in processing charges when applied for different Canara Bank loans, and the demat account. A penalty of Rs.100 has to be paid for not maintaining the minimum balance in the account.If you are interested to know about other bank accounts features also then here are some banks with best features City Bank Accounts, Dena Bank Accounts and Karnataka Bank Accounts etc.

You Can Also Here For Better Banking Experience

Canara Bank Opening and Closing Balance

For a savings account, the opening and closing balance in a month should be a minimum of Rs.1000 for accounts operating in semi-urban, urban, and metro regions and is about Rs.500 for accounts operating in rural regions. For a current account, the minimum opening and closing balance are Rs.1000 for accounts operating in rural and semi-urban regions and Rs.5000 for accounts operating in urban and metro cities. The minimum opening and closing balance for the Canara payroll package savings bank account is Rs.1000.There are different type of Canara Bank Deposit Schemes are available to their customers.

FAQ’s Related to Canara Bank Accounts

- Who is eligible for opening a salary account with Canara Bank?

2. What is the minimum monthly balance to be maintained in savings, current, and salary accounts?

3. What are the value-added services available with salary account?

As you know that a Fixed Deposit (FD) is an investment option offered by banks that gives you higher rate of interest than a regular savings account. By investing in an FD, you can achieve your financial goals comfortably due to higher returns offered by it.

Canara Bank FD provides an option to deposit lump sum amount for a specific period, ranging from 7 days to 10 years. You can choose any of the tenures offered by Canara Bank FD according to your convenience and financial objective. As soon as you select the tenure and deposit the amount in Canara Bank_ FD, it will start earning an interest based on the tenure of the deposit. Customer is allowed to deposit lump sum money into a fixed deposit only once into his FD account at the time of opening the account with the bank and afterwards he cannot deposit additional money in the same FD account.

You can also get tax benefits under section 80C of the Income Tax Act on an amount between Rs. 100 to 1.5 lakh by investing in Canara Bank FD for a tenure of 5 years or more.

Following table provides you Canara Bank FD Rates of various tenors. Also, given below is the facility/ option, through which you can calculate the interest rate and the maturity value of your Canara Bank FD for different tenures by clicking on the 'calculate' button provided in the table.

Canara Bank Fixed Deposit Interest Rates (as on 06 Mar 2021)

| Maturity Period | Interest Rate (p.a.) | Calculate Interest Rate |

|---|---|---|

| 30 Days | 3.00% | |

| 45 Days | 3.00% | |

| 60 Days | 4.00% | |

| 90 Days | 4.00% | |

| 120 Days | 4.05% | |

| 6 Months | 4.50% | |

| 9 Months | 4.50% | |

| 12 Months | 5.40% | |

| 2 Years | 5.35% | |

| 3 Years | 5.30% | |

| 4 Years | 5.30% | |

| 5 Years | 5.30% | |

| 10 Years | 5.30% |

Features & Benefits: Canara Bank Fixed Deposit

- Competitive interest rates are offered with flexible FD tenures to suit your investment plan.

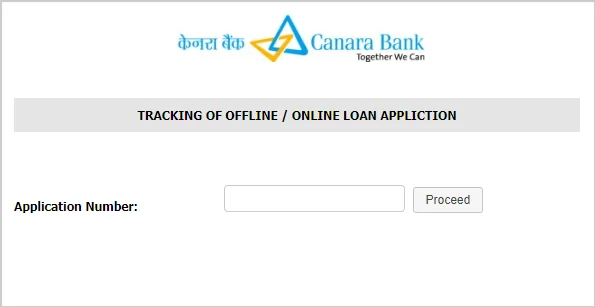

- FD account can be opened online or by visiting your nearest Canara Bank branch.

- No cap on the Maximum Amount of FD

- FD Tenures: 7 days to 10 years

- Different interest payout options such as monthly, quarterly, etc.

- Loan/ Overdraft against FD facility is available upto 85% of the FD amount.

- Easy and fast liquidity options are available.

- Nomination facility is available.

- Tax benefit of amount up to Rs 1,50,000, through tax saving term deposit scheme

- Part withdrawal facility and auto-renewal facilities are also available

- Senior citizens can enjoy higher interest rate as compared to regular citizens

- NRE, NRO and FCNR deposit facility is offered by the bank

Who is Eligible for Canara Bank Fixed Deposit

Any of the following persons is eligible to invest in fixed deposits (FD):

- Individual

- Minor

- HUF

- Proprietary Firm

- Partnership Firm

- Limited Liability Partnership (LLP)

- Company

- Association of Persons (AOP)

- Body of Individuals (BOI)

- Local Authority

- Trust

- Non-Resident Indian (NRI)

- Registered Society

Important Things to Know Before Investing in Fixed Deposits

- Always compare tenure-wise FD interest rates of different banks before finalizing the bank for opening an FD account, in order to get maximum interest rate on selected tenure.

- The tenure for most bank fixed deposits varies from 7 days to 10 years. You should choose the FD Tenure according to your convenience and objective behind investment.

- Opt for interest payout options such as monthly or quarterly, if required. Otherwise, choose cumulative option so that you can receive lump sum amount when FD gets matured.

- You can also avail loan or overdraft against FD, if you have immediate requirement of funds.

- If your annual income is non-taxable, you can submit Form 15G or Form 15H in order to avoid TDS.

- Don't forget to make nomination in your FD account.

- If you are a senior citizen then open your FD in a bank which offers extra interest of 0.25% to 0.75% to senior citizens.

- When you open fixed deposit online or offline, do not forget to give instructions on what to do on maturity of your FD. If you do not give any instruction, your fixed deposit will be renewed automatically on maturity.

Calculation of Interest on FD of Canara Bank

Interest on FD for different tenures is calculated in following manner:

- Simple interest is paid at maturity for fixed deposit tenure of less than 6 months.

- Interest is calculated on a quarterly basis for fixed deposit tenure of 6 months & above.

- Cumulative Interest/ re-investment interest is calculated every quarter, and is added to the Principal such that Interest is paid on the Interest earned in the previous quarter as well.

- In case of monthly deposit scheme, the interest shall be calculated for the quarter and paid monthly at discounted rate over the Standard FD Rate

Canara Bank FD Interest Calculator

Canara Bank FD Interest Calculator is an online financial tool that allows you to calculate the maturity value of your fixed deposit at the interest rate offered by bank. The amount of FD, interest rate, deposit tenure and compounding frequency of interest together determine the maturity amount of the FD at the end of the tenure.

Automatic Renewal of Bank FD

Bank FD matures on specific date. On maturity, if you have not given any specific instructions such as payout or renewal of FD, most of the banks automatically renew the FD for the same period for which it was initially made at the interest rate prevailing on the date of maturity of FD. This is called Automatic Renewal of Bank FD.

You should choose the option on the account opening form, if you do not want the bank to auto renew your FD. You have 2 options on the account opening form while depositing money in FD, first one is auto renew and second one is deposit of amount to your account after maturity. In case you have not mentioned any option on the account opening form then you will need to visit the bank branch on maturity day of your bank FD and opt for credit of the final proceeds of your bank FD into your savings account if you do not want an auto renewal of your FD.

Bank FD News Mar 2021

13-01-2020: SBI revised FD interest rate

SBI has announced a cut in retail fixed deposits of FD rates. The latest FD rates on SBI deposits is effective from 10th January 2020. The bank has cut the FD rates by 15 bps on long-term deposits maturing in 1 year to 10 years. Now FD interest rate for 7 to 45 days is 4.50%, for 46 to 179 days is 5.50%, for 180 days to 1 year is 5.80% and for 1 year to 10 years is 6.10%.

09-01-2020: Axis Bank reduced FD interest rate

Axis Bank reduced interest rates by up to 20 bps from January 9. FDs for less than Rs 2 crore and with the tenor of less than 1 year will earn 6.40%, for the tenor of 5 years to up to 10 years, FD rates is 6.50%.

07-01-2020: HDFC Bank deposits up by 25% (YoY) in 2019

The largest private sector lender HDFC Bank's deposits up by 25% (YoY) in 2019. Its deposits are at Rs 10.67 trillion as of December 31, 2019 growing by 25% as compared to Rs 8.52 trillion as of December 31, 2018..

24-12-2019: HDFC Bank revised FD interest rate

The revised rate for FDs maturing in 9 months 1 day to less than 1 year will be 6.05%. Term deposits maturing in 1 year to 2 years will fetch an interest rate of 6.3%, 2-3 years 6.40%, and 3 years to 10 years 6.3%.

01-12-2019: PNB cuts off FD rates

With effect from December 1, 2019, FDs for less than Rs 2 crore and the tenor of 271 days to below 1 year will be 6% for general customers and 6.5% for senior citizens. For the tenor of 5 years to up to 10 years, PNB has FD rates of 6.3% for general customers and 6.8% for senior citizens.

12-11-2019: ICICI Bank reduces FD interest rate

The interest rates on ICICI Bank FD for less than Rs 2 crore and the tenor of 185 days to 289 days will be 5.75%, for 5 years to up to 10 years will be 6.40% and 6.9% for senior citizens. Its interest rates will be effective from December 7, 2019.

Canara Bank Savings Account Interest Rate Monthly

Public Sector Banks FD Interest Rates

Canara Bank Online Account

| Allahabad Bank | Andhra Bank | Bank Of Baroda |

| Bank Of India | Bank Of Maharashtra | Canara Bank |

| Central Bank Of India | Corporation Bank | Idbi Bank |

| Indian Bank | Indian Overseas Bank | Oriental Bank Of Commerce |

| Punjab National Bank | Syndicate Bank | Uco Bank |

| Union Bank Of India | United Bank Of India | Vijaya Bank |

| State Bank Of India | State Bank Of Mysore | State Bank Of Patiala |

| State Bank Of Travancore | State Bank Of Bikaner And Jaipur | Punjab And Sind Bank |

Canara Bank Nre Interest Rates

Private Sector Banks FD Interest Rates

Canara Bank Interest Rates 2020

| Axis Bank | Bandhan Bank Limited | Catholic Syrian Bank Limited |

| City Union Bank Limited | Dcb Bank Limited | Dhanalakshmi Bank |

| Federal Bank | Hdfc Bank | Icici Bank Limited |

| Idfc Bank Limited | Jammu And Kashmir Bank Limited | Indusind Bank |

| Karnataka Bank Limited | Karur Vysya Bank | Kotak Mahindra Bank Limited |

| Laxmi Vilas Bank | The Nainital Bank Limited | Rbl Bank Limited |

| South Indian Bank | Tamilnad Mercantile Bank Limited | Yes Bank |

| Equitas Small Finance Bank Limited | Ujjivan Small Finance Bank Limited | Utkarsh Small Finance Bank |

| Suryoday Small Finance Bank | Au Small Finance Bank Limited | Capital Small Finance Bank Limited |

| Esaf Small Finance Bank Limited | North East Small Finance Bank Limited | Fincare Small Finance Bank Ltd |