Dbs Fixed Deposit Promotion

Looking for the best fixed deposits in November 2020 in Singapore? If you have 50K, you should read my previous post on Where Will You Put 50K? before you jump straight into Fixed Deposits.

Open DBS PayLah! And scan to pay at FavePay QRs for up to 20% instant partner cashback Get S$30 on your first DBS Remit transfer Only for the first 250 customers to. UOB may change the terms and conditions of this promotion (including the promotion period, promotional interest rate, fixed deposit tenor, or terminate this promotion) at any time without having to provide any reason or prior notice. It is important to read and accept the full terms and conditions that apply to the Promotional Interest Rate(s.

With the current economic slowdown, ICBC and DBS are leading the pack when it comes to accessible fixed deposits. ICBC offers 0.6% p.a. For 12-month tenures with an initial deposit of just $500 in fresh funds, while DBS offers 0.6% p.a. For 8-month or shorter tenures for new placements of $1,000 and above. Enjoy HKD preferential interest rates up to 0.25% p.a. Online Time Deposit Offer From now until 31 March 2021, place your Time Deposit via DBS iBanking (using the specified promotion code), DBS digibank or DBS iWealth ® App to enjoy preferential interest rates! HKD preferential interest rates up to 0.25% p.a.

Fixed Deposit or Singapore Savings Bonds?

Forget about the Singapore Savings Bonds. The 1 year interest rate for December 2020 Singapore Savings Bonds has fallen as low as 0.24%, thus any of the fixed deposits promotion below will beat the Singapore Savings Bonds.

The Alternatives – Short Term Endowments

I have shared many other financial instruments that is similar to what fixed deposits can offer. One good alternative is buying a short term endowment plan. Endowment plans guarantee your capital upon maturity which is similar to what fixed deposits offer. Most of the short term endowment plans are on limited tranche basis.

At the point of writing, the 10th Tranche of China Taiping i-Save (1.96% for 3 years) is fully subscribed.

The Alternatives – GIGANTIC, Dash EasyEarn or Singlife

Alternatively, you can check out GIGANTIC, Dash EasyEarn or Singlife whereby there is no lock in period and they offer a higher returns as compared to fixed deposits. Personally, I have signed up a Singlife Account and Dash EasyEarn.

Nevertheless, if you still prefer traditional fixed deposits, below are the best fixed deposits promotion that I have found for November 2020. The current low interest rates offered by most banks remained unattractive to me.

Among the banks below, I prefer the fixed deposit from DBS given that DBS offer much higher interest rate per annum for a 12 or 18 months placement as compared to the rest of the banks.

DBS is the best fixed deposit in November 2020!

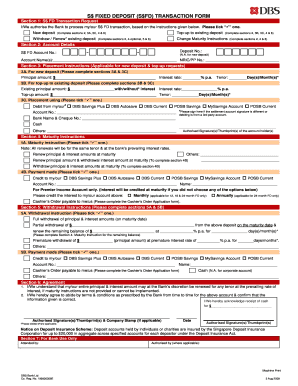

DBS Fixed Deposit (Recommended)

Interest Rate: Refer below, Minimum Placement: S$1,000, Promotion Valid Until: Not stated

For a minimum amount of S$1,000, you can perform a fixed deposit placement with DBS.

For a 12 months placement of S$10,000 at 1.15% p.a., the interest that you will receive upon maturity is S$115.

If you can afford a longer period such as 18 months, the interest rate is 1.30% p.a. which will give you $195.84 upon maturity.

I have boxed up the period and the corresponding interest rates which I find attractive.

Hong Leong Finance Deposit Promotion

Interest Rate: Up to 0.73%, Minimum Placement: S$20,000, Promotion Valid Until: Not stated

For 12 months placement of S$20,000 at 0.73% p.a., the interest that you will receive upon maturity is S$146.00.

From now till 1st Mar 2021, you also stand a chance to win in the PayNow Monthly E-Gadget Draw when you use PayNow to deposit or pay loans with Hong Leong Finance.

MayBank Time Deposit

Interest Rate: Refer below, Minimum Placement: S$10,000, Promotion Valid Until: Not stated

For 12 months placement of S$10,000 at 0.45% p.a., the interest that you will receive upon maturity is S$45.00.

UOB Time Deposit

Interest Rate: 0.55%, Minimum Placement: S$20,000, Promotion Valid Until: 30th November 2020

UOB’s time deposit interest rate remains the same at 0.55% p.a. in November.

For 10 months placement of S$20,000 at 0.55% p.a., the interest that you will receive upon maturity is S$91.67.

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$20,000 | 10 months | 0.55% p.a. |

OCBC Time Deposit

Interest Rate: 0.50%, Minimum Placement: S$5,000, Promotion Valid Until: 30th November 2020

OCBC’s time deposit interest rate remains the same at 0.50% p.a. in November.

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$5,000 | 12 months | 0.50% p.a. |

For 12 months placement of S$5,000 at 0.50% p.a., the interest that you will receive upon maturity is S$25.00.

CIMB Fixed Deposit

Interest Rate: Refer below, Minimum Placement: S$5,000, Promotion Valid Until: 30th November 2020

CIMB is offering a promotional rate of 0.35% p.a. for a 3 months placement. This is 0.05% more than the norm. The minimum placement for this promotion is S$10,000. You will receive S$8.75 after 3 months upon maturity of your S$10,000 placement.

If you have S$50,000 sitting in your Fast Saver account, you can opt to put them into this fixed deposit promotion which gives you 0.35% p.a. for a 3 months lock in period since the first 50K in Fast Saver earns you 0.30% p.a.

Standard Chartered Bank Singapore Dollar Time Deposit

Interest Rate: 0.20% to 0.30%, Minimum Placement: S$25,000, Promotion Valid Until: 30th November 2020

For 6 months placement of S$25,000 at 0.20% p.a., the interest that you will receive upon maturity is S$25.00.

If you happen to be a priority banking customer, for 6 months placement of S$25,000 at 0.30% p.a., the interest that you will receive upon maturity is S$37.50.

| Minimum Placement | Tenure | Promotional Rate | Priority Banking Preferential Rate |

| S$25,000 | 6 months | 0.20% p.a. | 0.30% p.a. |

Uh oh, the event has ended. Don't miss out again, get the latest news via Newsletter, Telegram, Facebook, Twitter or RSS feed!

| Starts | 2 Oct 2020 (Fri) | Ends | 8 Nov 2020 (Sun) |

|---|---|---|---|

| Location | DBS/POSB |

| SINGPromos is now on Telegram. Click here to follow us now |

DBS/POSB Singapore Dollar (S$) Fixed Deposit Account gives you the opportunity to maximise your savings with attractive interest, while keeping your funds secure. Valid as of 5 November 2020.

Benefits

- Affordability and Convenience: fixed deposit amount begin at S$1,000 with a deposit tenor of your choice, and you can begin a new placement via iBanking or at any of DBS/POSB branches

- Added value: you may use your S$ Fixed Deposit as collateral for credit facilities (subject to credit approval) and may make a placement using cash.

Eligibility and Requirements

- You are eligible for this account if you are at least 12 years old. For customers younger than 12 years, a trust minor account may be opened with a parent or legal guardian who is at least 21 years old.

Note: The maximum 1.3% p.a. only applies to 18 month deposits of up to a maximum of $49,999. Interest rates for tenors of 12 months and above are applicable only to rollover of existing placements at the same tenor. For 1.1%, it is applicable for 11-month deposits of up to $19,999.

Uob Fixed Deposit Promotion

Rates as of 2 Oct 2020

Effective Date: 02/10/2020

Dbs Fixed Deposit Promotion Singapore

| Period | $1,000 – $9,999 | $10,000 – $19,999 | $20,000 – $49,999 | $50,000 – $99,999 | $100,000 – $249,999 | $250,000 – $499,999 | $500,000 – $999,999 |

|---|---|---|---|---|---|---|---|

| 1 mth | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 2 mths | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 3 mths | 0.1500 | 0.1500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 4 mths | 0.1500 | 0.1500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 5 mths | 0.1500 | 0.1500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 6 mths | 0.2000 | 0.2000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 7 mths | 0.4000 | 0.4000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 8 mths | 0.6000 | 0.6000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 9 mths | 0.9500 | 0.9500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 10 mths | 1.1000 | 1.1000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 11 mths | 1.1000 | 1.1000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 12 mths | 1.1500 | 1.1500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 18 mths | 1.3000 | 1.3000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 24 mths | 0.9000 | 0.9000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 36 mths | 0.8500 | 0.8500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 48 mths | 0.7500 | 0.7500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 60 mths | 0.7500 | 0.7500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

Interest rates are indicative. Rates apply to individual accounts only.

For more info, click here

Share this with your friends & family members on Facebook!

Related News

Dbs Fixed Deposit Promotion Rates

- Standard Chartered: Earn 0.50% p.a. with 3-mth time deposits till 31 March 2021

Earn attractive returns when you deposit minimum fresh funds of S$25,000.... - Triple Three: Enjoy 1-for-1 weekend lunch buffet with DBS/POSB cards till 31 Mar 2021

Two adults only need to pay the price for one adult.... - Singapore Savings Bond (SSB): Earn up to 1.15% p.a. in the latest bond – Apply by 26 March 2021

Earn returns with a minimum sum of $500 in the latest Singapore Savings Bond... - EZ-Link releases new Spider-Man LED EZ-Link charm that lights up when activated (From 18 Feb 2021)

Spider-Man LED EZ-Link charm lights up when activated!... - Get a S$15 Amazon.sg Gift Card when you spend S$150 or more using Visa cards till 21 Feb 2021

Get an Amazon.sg Gift Card added to your Amazon account....