Icici Bank Deposit Rates

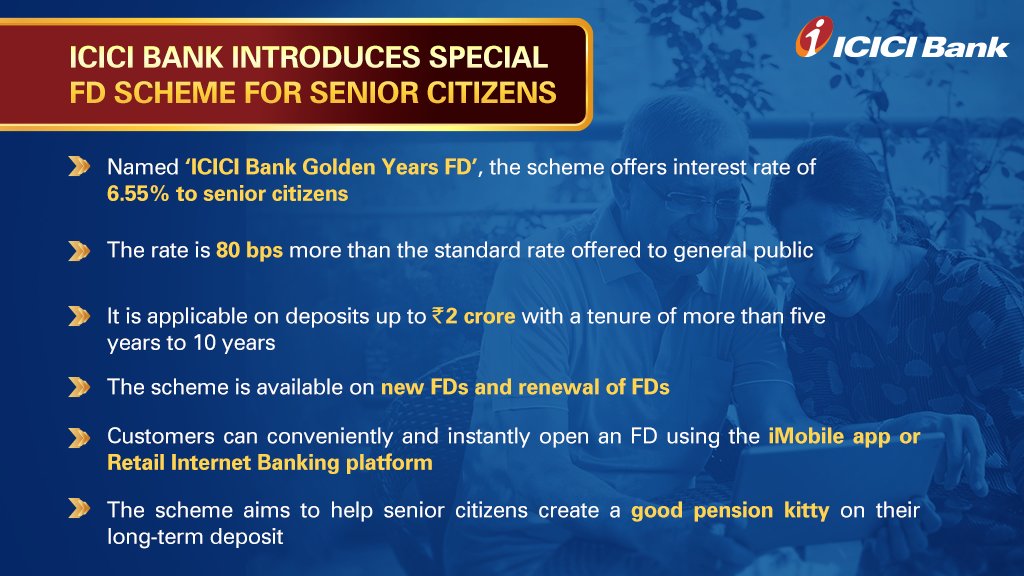

The Indian Bank FD interest rates are applied quarterly or monthly with a discount or at maturity. Senior citizens are paid 0.50% higher interest rate than regular Indian Bank FD rates for an aggregate deposit amount of up to Rs 10 crore. It comes with nomination facility. It does allow for foreclosure before completing 5 years. ICICI bank staff (including retired staff) will get additional 1% rate of interest on domestic deposit below ₹ 2 Cr. # ICICI Bank Golden Years FD (w.e.f 20th May’20): Now get an exclusive additional interest rate of 0.30% per annum on your Fixed Deposits. ICICI Bank, a leading private sector bank in India, offers Netbanking services & Personal banking services like Accounts & Deposits, Cards, Loans, Insurance & Investment products to meet your banking needs. Interest Rate on ICICI Bank Fixed Deposit. The interest rate on Fixed Deposit with ICICI Bank varies with the amount deposited and maturity period. The interest rate varies from 3% up to 7.75%. In a fixed deposit.

- Icici Bank Fixed Deposit Rates

- Icici Bank Deposit Rates

- Icici Bank Deposit Interest Certificate Online

- Commercial Bank Fd Rates

Login

Icici Bank Fixed Deposit Rates

Rates

- Fixed Rate Deposits

- Exchange Rates

- Loan Against Deposit Rates

- Bahrain toll free number

- 80004877

- Fax

- +973 17221200

- For more details click here

- Bahrain toll free number

- 80004877

- Fax

- +973 17221200

- For more details click here

- Bank Accounts

- Deposits

- Loan Against Deposit

- Other Segments

- Other ICICI Bank Website

- ICICI Bank Country Websites

ICICI Bank Limited Bahrain Branch – Loan against Deposit Interest Rates (effective from February 24, 2020, till next change)

TERM LOAN - USD Fixed

| Maturity | Bank's Fixed Rate in USD for Client |

|---|---|

| 3 month | |

| 6 month | 2.82% |

| 1 year | |

| 2 year | 3.23% |

| 3 year |

TERM LOAN - BHD Fixed

| Maturity | Bank's Fixed Rate in BHD for Client |

|---|---|

| 3 month | |

| 6 month | 3.80% |

| 1 year | |

| 2 year | 4.53% |

| 3 year |

TERM LOAN - USD Floating

| Maturity | Bank's Floating Rate in USD for client (USD 3m Libor+) |

|---|---|

| 3 month | |

| 6 month | 1.15% |

| 1 year | |

| 2 year | 1.75% |

| 3 year |

Icici Bank Deposit Rates

OVERDRAFT LOAN

| Maturity | Bank's Floating Rate in USD for client (USD 3m Libor+) |

|---|---|

| 3 month | |

| 6 month | 1.15% |

| 1 year |

Icici Bank Deposit Interest Certificate Online

Processing Fee: 50 BHD or equivalent.

Please note: To avail Credit facility against deposits from ICIC Bank Bahrain branch, applicant should have an existing Relationship/Account.

ICICI Bank Limited's Bahrain Branch is Licensed and regulated as an overseas conventional retail bank by the Central Bank of Bahrain, located at Manama Centre, Manama, P.O. Box-1494, Bahrain.

Commercial Bank Fd Rates

| Maturity Period | Interest rates (per cent per annum) w.e.f. October 21, 2020 | Interest rates (per cent per annum) w.e.f. December 04, 2020 | ||

|---|---|---|---|---|

| Single deposit of less than ₹ 20.0 million | Single deposit of ₹ 20.0 mn & above but less than 50.0 mn | |||

| General | **Senior Citizen | General | **Senior Citizen | |

| 7 days to 14 days | 2.50% | 3.00% | 2.50% | 2.50% |

| 15 days to 29 days | 2.50% | 3.00% | 2.50% | 2.50% |

| 30 days to 45 days | 3.00% | 3.50% | 2.75% | 2.75% |

| 46 days to 60 days | 3.00% | 3.50% | 2.75% | 2.75% |

| 61 days to 90 days | 3.00% | 3.50% | 3.00% | 3.00% |

| 91 days to 120 days | 3.50% | 4.00% | 3.00% | 3.00% |

| 121 days to 184 days | 3.50% | 4.00% | 3.00% | 3.00% |

| 185 days to 210 days | 4.40% | 4.90% | 3.50% | 3.50% |

| 211 days to 270 days | 4.40% | 4.90% | 3.50% | 3.50% |

| 271 days to 289 days | 4.40% | 4.90% | 3.65% | 3.65% |

| 290 days to less than 1 year | 4.40% | 4.90% | 3.65% | 3.65% |

| 1 year to 389 days | 4.90% | 5.40% | 3.75% | 3.75% |

| 390 days to < 18 months | 4.90% | 5.40% | 3.75% | 3.75% |

| 18 months to 2 years | 5.00% | 5.50% | 3.75% | 3.75% |

| 2 years 1 day to 3 years | 5.15% | 5.65% | 4.25% | 4.25% |

| 3 years 1 day to 5 years | 5.35% | 5.85% | 4.25% | 4.25% |

| 5 years 1 day to 10 years | 5.50% | #6.30% | 4.25% | 4.25% |

| 5 Years (80C FD) – Max to ₹ 1.50 lac | 5.35% | 5.85% | NA | NA |